U.S. Dairy Cold Storage Update – Feb ’22

Executive Summary

U.S. cold storage figures provided by the USDA were recently updated with values spanning through Jan ’22. Highlights from the updated report include:

- Jan ’22 U.S. butter stocks increased seasonally from the two year low level experienced throughout the previous month but remained 33.3% below previous year levels, reaching a three year low seasonal level. The seasonal build in butter stocks was the smallest experienced throughout the past 24 years.

- Jan ’22 U.S. cheese stocks remained at a record high seasonal level for the ninth consecutive month, finishing 2.6% above previous year levels. On a days of usage basis, cheese stocks finished slightly below previous year levels, however.

Additional Report Details

Butter – Stocks Reach a Three Year Low Seasonal Level, Down 33.3% YOY

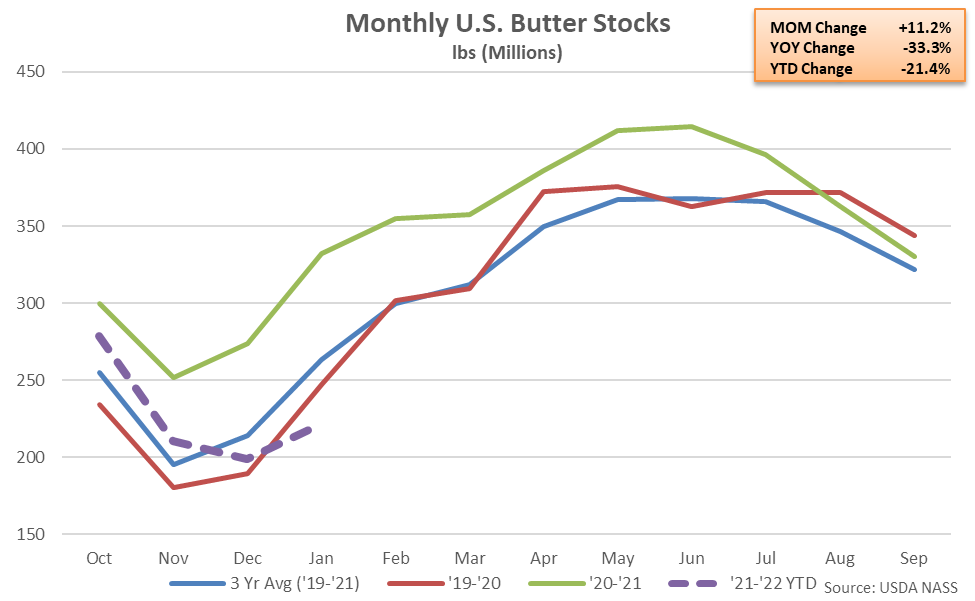

According to the USDA, Jan ’22 U.S. butter stocks increased seasonally from the two year low level experienced throughout the previous month but remained 33.3% below previous year levels. The YOY decline in butter stocks was the sixth experienced in a row and the largest experienced throughout the past seven years on a percentage basis. Butter stocks had finished above previous year levels over 25 consecutive months through Jul ’21, prior to declining on a YOY basis over the six most recently available data points.

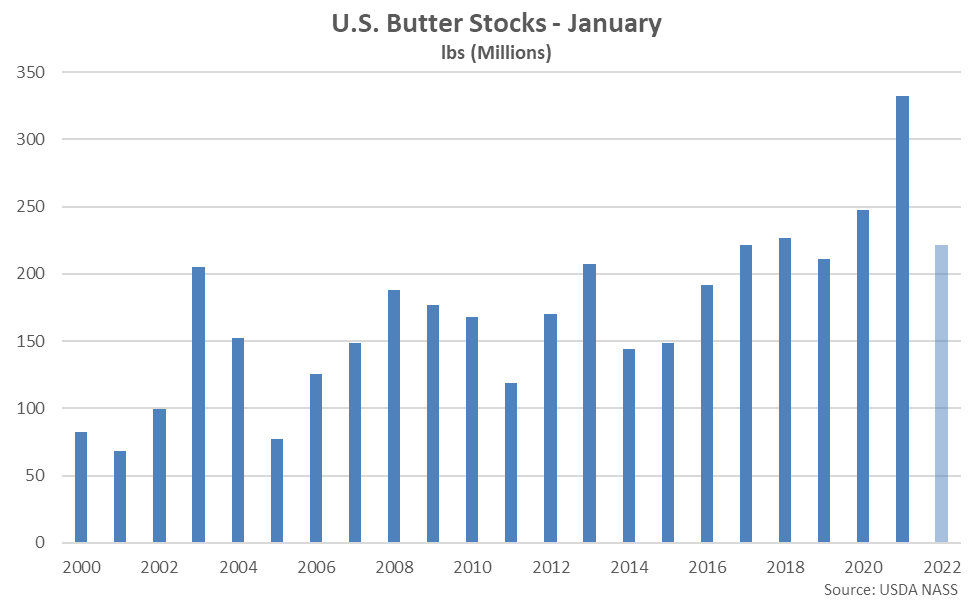

The month-over-month increase in butter stocks of 22.3 million pounds, or 11.2%, was smaller than the ten year average December – January seasonal build of 49.1 million pounds, or 32.6%. The December – January build in butter stocks was the smallest experienced throughout the past 24 years on an absolute basis. Butter stocks typically reach seasonal low levels throughout the month of November, prior to rebounding seasonally throughout the month of December and the first half of the following calendar year. Butter stocks reached a three year low seasonal level for the month of January.

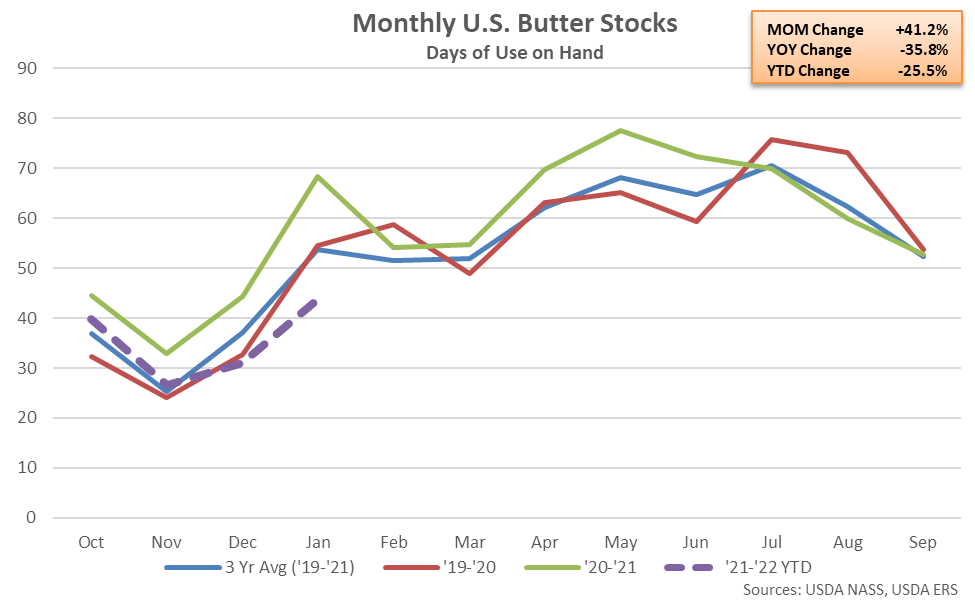

On a days of usage basis, Jan ’22 U.S. butter stocks also finished below previous year levels. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of January, butter stocks on a days of usage basis declined YOY for the seventh consecutive month, finishing down 35.8% and reaching a three year low seasonal level.

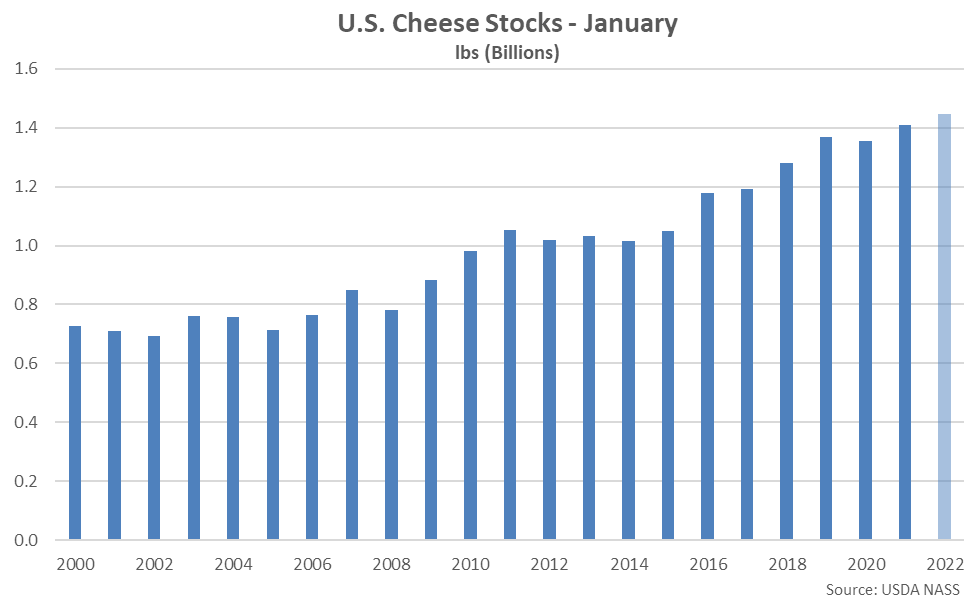

Cheese – Stocks Remain at a Record High Seasonal Level, Finish 2.6% Higher YOY

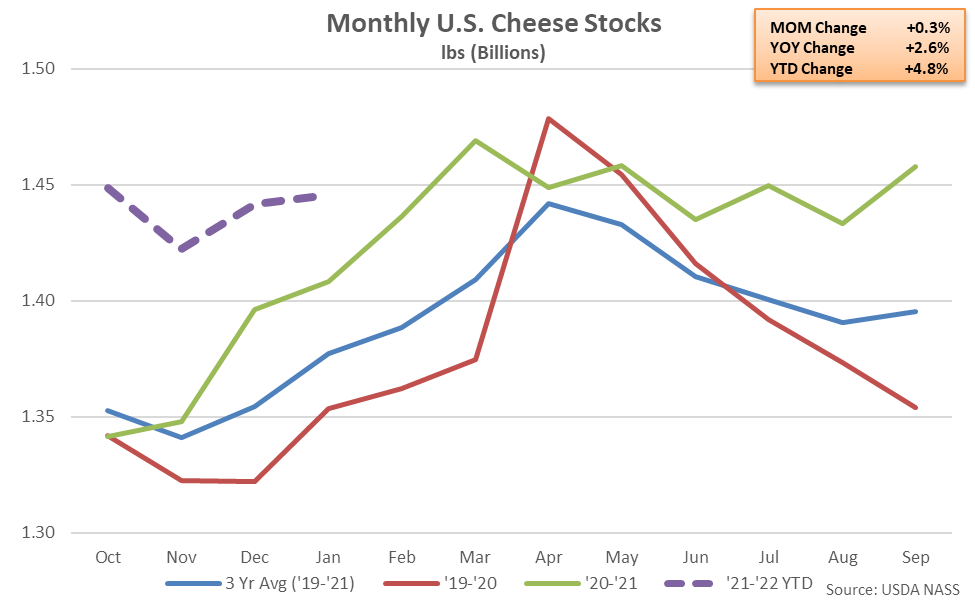

Jan ’22 U.S. cheese stocks rebounded seasonally to a three month high level while finishing 2.6% above previous year levels, remaining at a record high seasonal level for the ninth consecutive month. The YOY increase in cheese stocks was the 14th experienced throughout the past 15 months but the smallest experienced throughout the past seven months on a percentage basis.

American cheese stocks finished 3.7% higher on a YOY basis throughout the month while other-than-American cheese stocks finished 1.3% above previous year levels. The month-over-month increase in cheese stocks of 3.9 million pounds, or 0.3%, was smaller than the ten year average December – January seasonal build of 16.6 million pounds, or 1.5%.

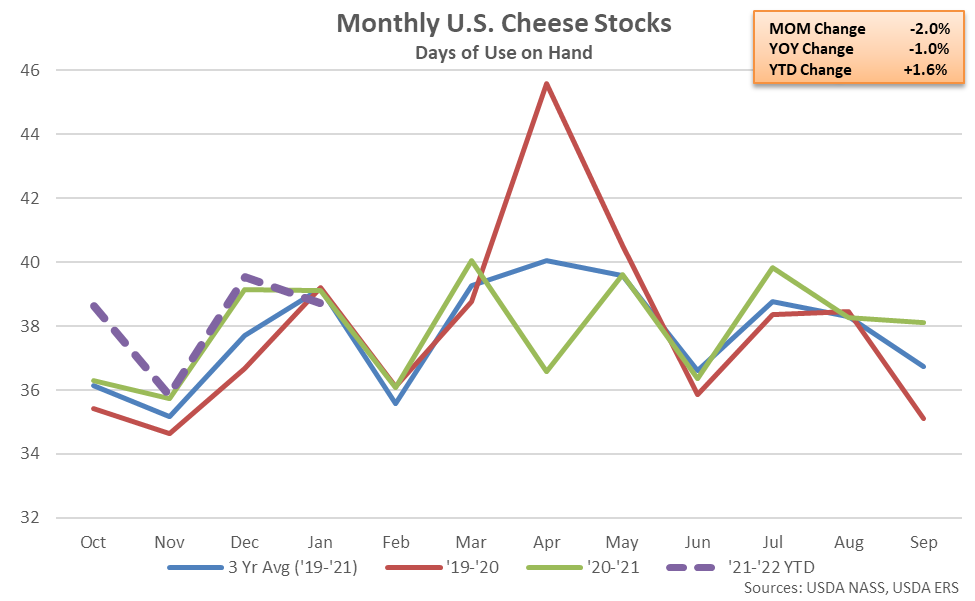

On a days of usage basis, Jan ’22 U.S. cheese stocks finished slightly below previous year levels, however. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of January, cheese stocks on a days of usage basis declined YOY for the first time in the past five months, finishing down 1.0% and reaching a four year low seasonal level.

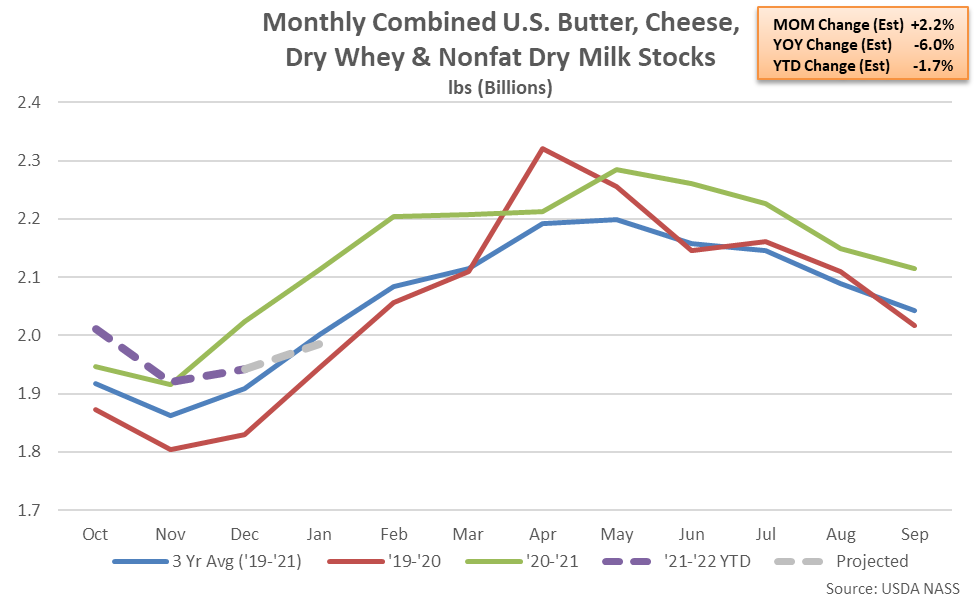

Combined Dairy Product Stocks – Jan ’22 Stocks Projected to Remain Below Previous Year Levels

Combined stocks of butter, cheese, dry whey and nonfat dry milk finished 4.0% below previous year levels throughout Dec ’21, finishing lower on a YOY basis for just the second time in the past 23 months. Combined stocks of butter, cheese, dry whey and nonfat dry milk are projected to remain below previous year levels throughout Jan ’22 when using actual butter and cheese stock figures and previous month YOY changes in dry whey and nonfat dry milk stocks, declining by an estimated 6.0% on a YOY basis. The estimated YOY decline in combined stocks would be the largest experienced throughout the past seven years on a percentage basis. Jan ’22 dry whey and nonfat dry milk stock figures are scheduled to be available Mar 4th.