U.S. Milk Production Update – Feb ’22

Executive Summary

U.S. milk production figures provided by the USDA were recently updated with values spanning through Jan ’22. Highlights from the updated report include:

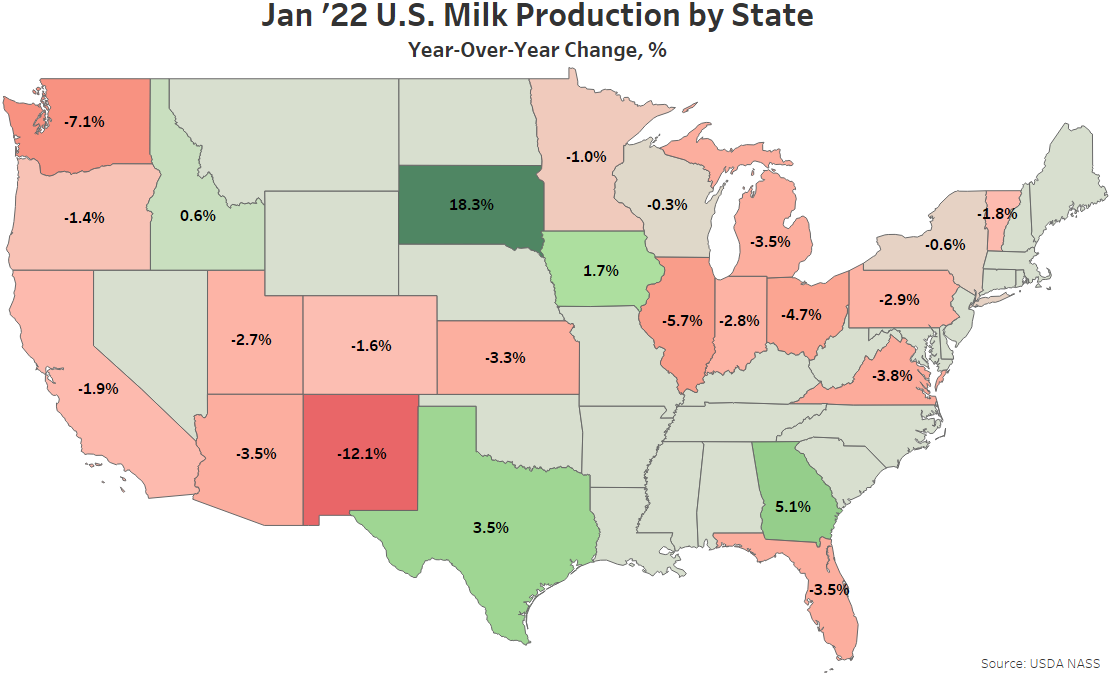

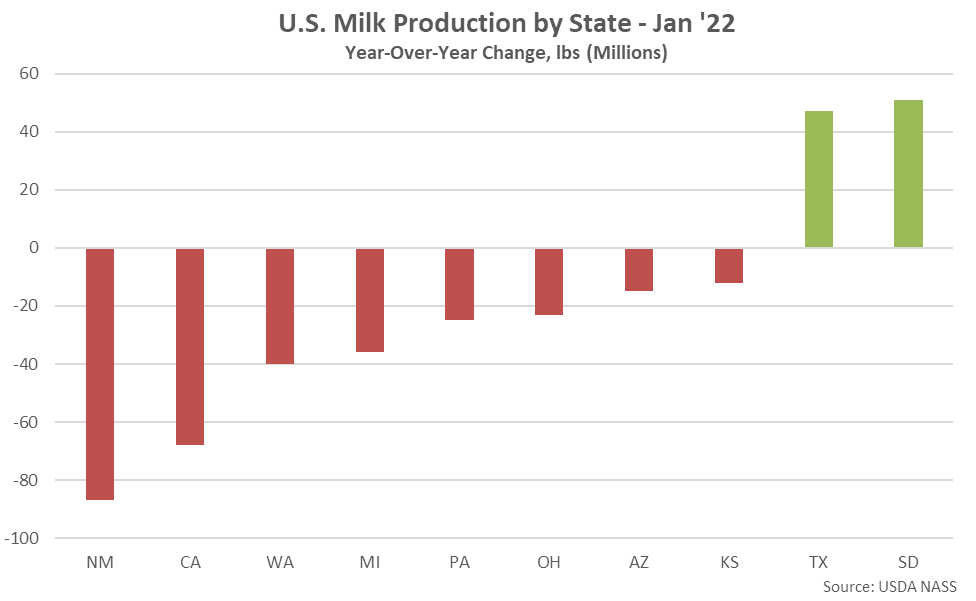

- U.S. milk production volumes remained below previous year levels for the third consecutive month throughout Jan ’22, finishing down 1.6%. The YOY decline in milk production volumes was the largest experienced throughout the past 17 years on a percentage basis. YOY declines in production on an absolute basis were led by New Mexico, followed by California and Washington. South Dakota and Texas milk production volumes finished most significantly above previous year levels throughout the month.

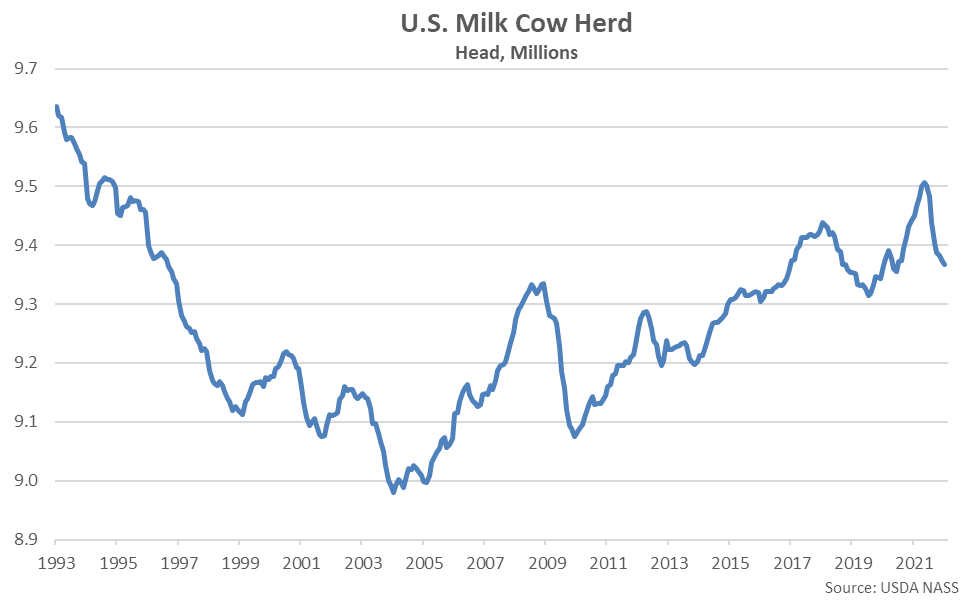

- The Dec ’21 U.S. milk cow herd figure was revised 2,000 head below levels previously stated while the Jan ’22 figure declined an additional 5,000 head from the previous month’s revised figure, reaching a 19 month low level. The U.S. milk cow herd currently stands at 9.368 million head, down 139,000 head from the 26 year high level experienced throughout May ’21 and finishing 82,000 head below the previous year.

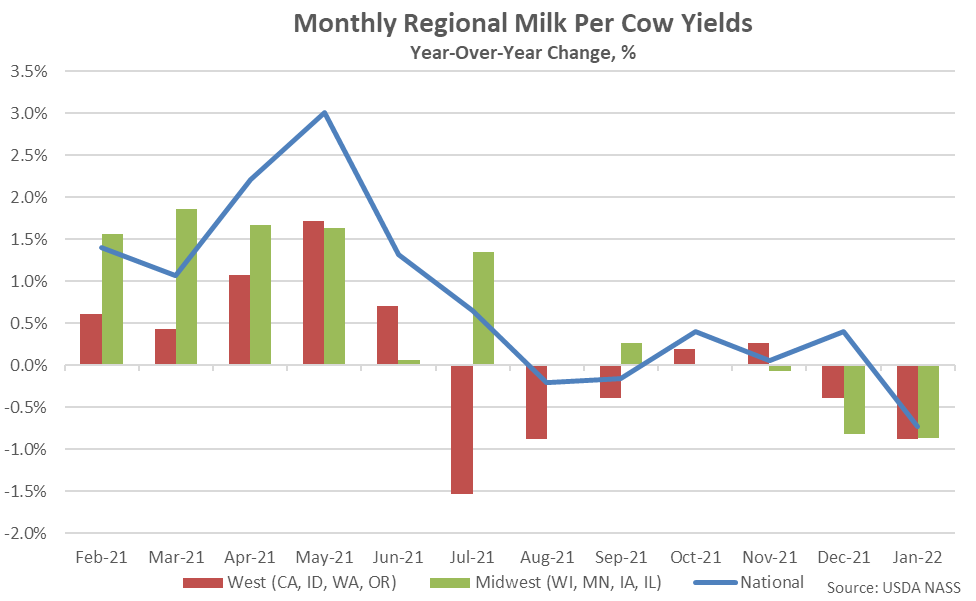

- U.S. milk per cow yields finished 0.7% below previous year levels throughout Jan ’22, declining on a YOY basis for the first time in the past four months.

Additional Report Details

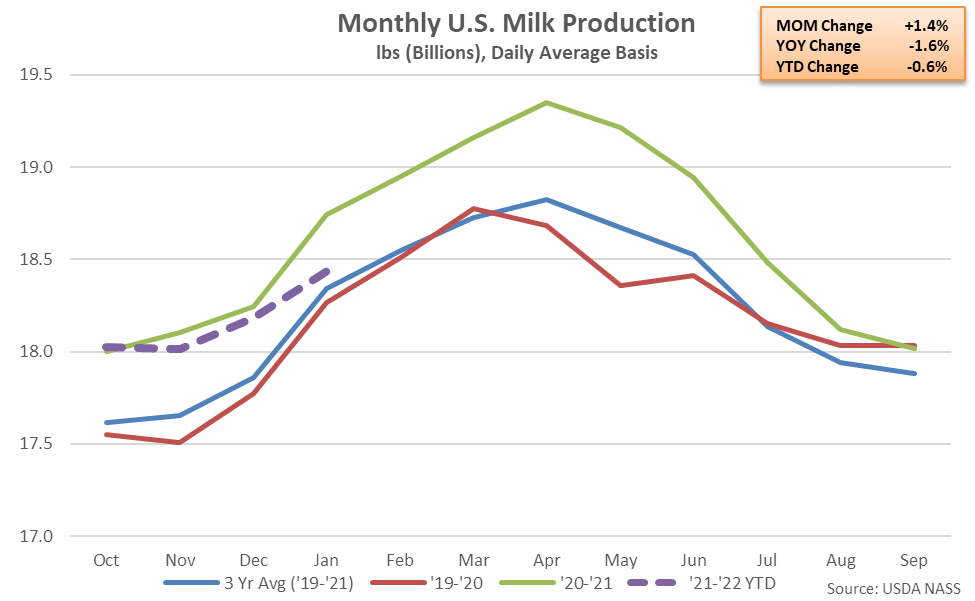

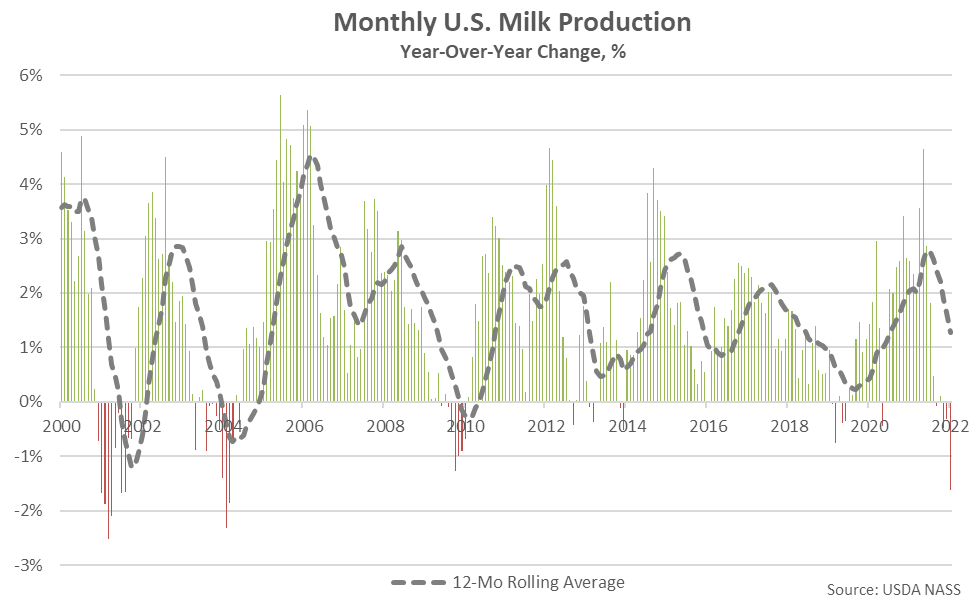

According to the USDA, Jan ’22 U.S. milk production volumes increased seasonally to a six month high level but remained 1.6% below previous year figures. The month-over-month increase in production volumes of 1.4% was smaller than the ten year average December – January increase of 2.3%.

U.S. milk production volumes had finished higher on a YOY basis over 61 consecutive months from Jan ’14 – Jan ‘19, reaching the longest period of consecutive growth on record, prior to declining by a total of 0.3% from Feb ’19 – Jun ’19. Milk production volumes had rebounded throughout more recent months, finishing higher over 27 of the past 28 months through Oct ’21 before declining throughout the three most recent months of available data. The Jan ’22 YOY decline in U.S. milk production volumes was the largest experienced throughout the past 17 years on a percentage basis.

’20-’21 annual U.S. milk production volumes finished 2.4% above previous year levels, reaching a 13 year high annual growth rate. ’21-’22 YTD production volumes have declined by 0.6% on a YOY basis throughout the first third of the production season, however. The USDA is projecting U.S. milk production volumes will increase 0.4% throughout the 2022 calendar year.

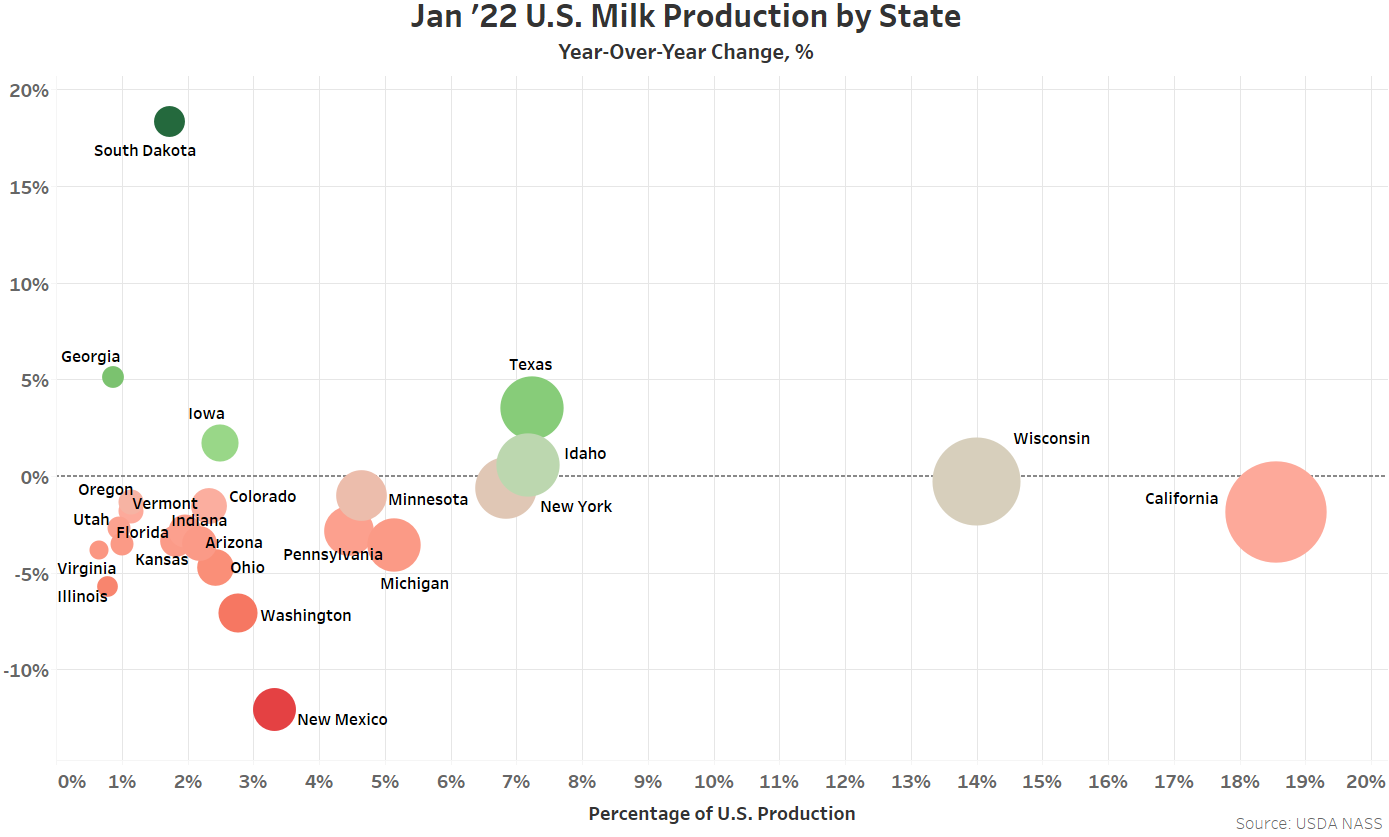

YOY declines in production on a percentage basis were led by New Mexico (-12.1%), followed by Washington (-7.1%) and Illinois (-5.7%), while production volumes finished most significantly higher YOY on a percentage basis within South Dakota (+18.3%), Georgia (+5.1%) and Texas (+3.5%). Overall, 19 of the 24 states milk production figures are provided for experienced YOY declines in production throughout the month.

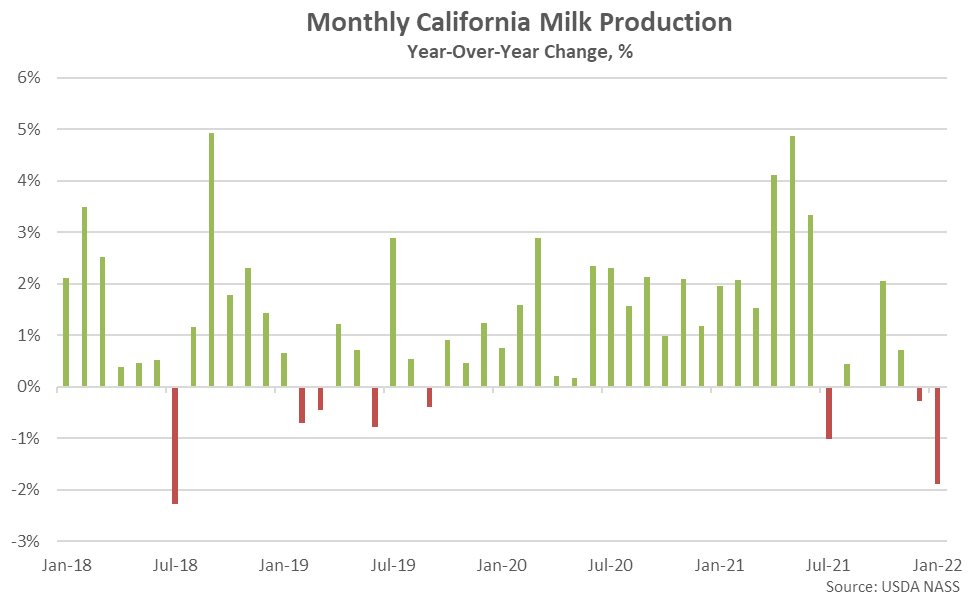

California milk production volumes declined 1.9% on a YOY basis throughout Jan ’22, finishing below previous year levels for the second consecutive month. The YOY decline in California milk production volumes was the largest experienced throughout the past three and a half years on a percentage basis. California accounted for 18.6% of total U.S. milk production volumes throughout the month, leading all states.

Eight of the top ten largest milk producing states experienced YOY declines in production throughout Jan ’22, as milk production within the top ten milk producing states declined by a weighted average of 1.6% throughout the month. The aforementioned states accounted for nearly three quarters of the total U.S. milk production experienced during Jan ’22. Production volumes outside of the top ten largest milk producing states declined by 1.8% on a YOY basis throughout the month.

Jan ’22 YOY declines in milk production on an absolute basis were led by New Mexico, followed by California and Washington, while YOY increases in production on an absolute basis were most significant throughout South Dakota, followed by Texas.

The Dec ’21 U.S. milk cow herd figure was revised 2,000 head below levels previous stated while the Jan ’22 figure declined an additional 5,000 head from the previous month’s revised figure, reaching a 19 month low level. The U.S. milk cow herd currently stands at 9.368 million head, down 139,000 head from the 26 year high level experienced throughout May ’21 and finishing 82,000 head below the previous year.

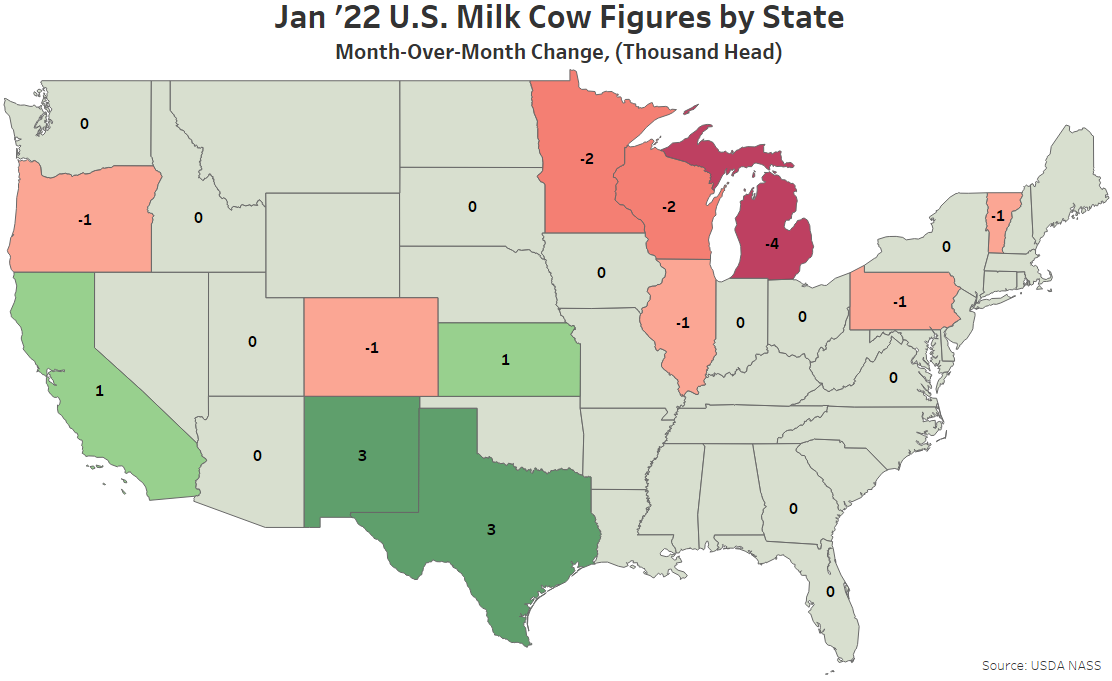

Month-over-month declines in milk cow herds were led by Michigan, followed by Wisconsin, Minnesota, Pennsylvania, Colorado, Oregon, Vermont and Illinois. Month-over-month increases in milk cow herds were led by Texas and New Mexico, followed by California and Kansas.

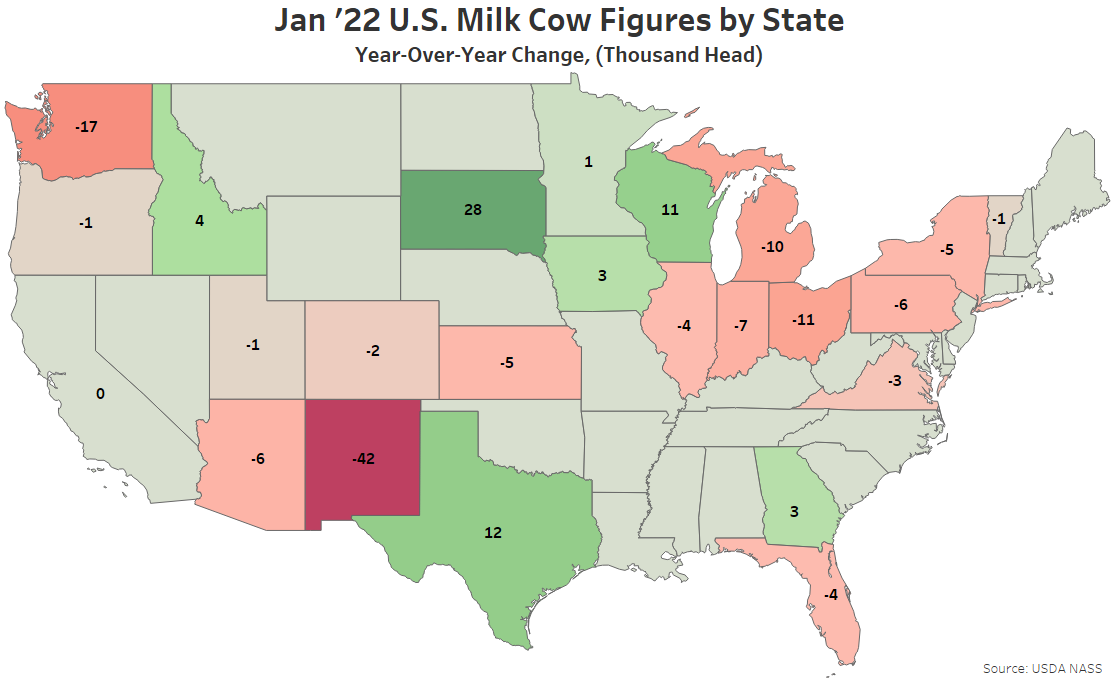

Jan ’22 YOY declines in milk cow herds continued to be led by New Mexico, followed by Washington and Ohio, while the South Dakota, Texas and Wisconsin milk cow herds finished most significantly higher on a YOY basis throughout the month.

U.S. milk per cow yields finished 0.7% below previous year levels throughout Jan ’22, declining on a YOY basis for the first time in the past four months. U.S. milk per cow yields had finished below previous year levels just once over a five and a half year period ending Jul ’21, prior to declining throughout the months of Aug-Sep ’21. The Jan ’22 YOY decline in milk per cow yields was the largest experienced throughout the past 20 months.

Yields experienced throughout the Midwestern states of Wisconsin, Minnesota, Iowa and Illinois finished 0.9% below previous year levels throughout Jan ’22 however yields experienced throughout the Western states of California, Idaho, Washington and Oregon also finished 0.9% lower on a YOY basis.